Can you skip a payment with Sezzle?

Depending on government policies, you may be able to reschedule your payments up to three times, for a fee. So even though payments can only be moved out two weeks at a time from the originally scheduled dates, you may have two additional schedules that can be used to move payments back, if necessary.

What happens if I default to Sezzle? If a user is unable to make a payment, Sezzle promises that there will be no collection process and it will not adversely affect your credit.

Can you skip a Sezzle payment?

Sezzle allows you to reschedule payments. Each order comes with a free reschedule, and then the option to reschedule twice more for a $ 5 fee. We recommend changing the schedule as soon as you know you need it (at least 48 hours in advance), because once the payment has started processing, it can not be changed.

What happens if you dont pay your Sezzle?

If you do not pay, you will receive reminders from Sezzle and you will be charged a late fee of $ 10. They encourage you to make your payments on time because lost payments can have a negative impact on your boundaries with Sezzle and your ability to use Sezzle in the future.

Do you have to make a down payment with Sezzle?

In most cases, 25% of the order amount must be paid in advance (also called the « advance payment » or « first installment »), with the remaining amount divided into three additional installments, each at two-week intervals.

What happens if you don’t pay Sezzle payment?

If you are unable to make a scheduled payment according to your payment history, adjusted for any rescheduled payments that we have accepted, and the payment error continues for more than 2 days after the date of payment (« failed payment »), then we will, there it is allowed by law, impose an office activation fee …

What happens if I never pay my Sezzle order?

If you miss a payment with Sezzle and are more than two days late, your account will be temporarily disabled. You will not be able to make more purchases until you reactivate your account and pay a $ 10 fee. Any outstanding amounts are transferred to the next payment date.

What happens if you pay Sezzle late?

When a payment fails, a fee * is added to the installment, your due dates are automatically rescheduled and no new purchases or other payment schedules are approved until the payment is resolved.

Can you pay Sezzle off early?

Although it is not possible to pay down an order in full immediately with Sezzle at checkout, you can pay your installments early once the order has been placed. We do not charge any prepayment fees or interest, so there is no direct benefit to paying down an order early.

Does Sezzle damage your credit? A standard Sezzle account does not report to credit bureaus. Therefore, your loan payments or lost payments have no effect on your FICO score, unless you have chosen to join Sezzle Up.

What is the catch with Sezzle?

What is the catch? No catch here! Sezzle is completely interest-free for shoppers because we are committed to strengthening the next generation financially. Sellers pay us a fee, so you have the freedom to buy now and pay later.

How much does Sezzle approve you for?

Sezzle has a limit of $ 2500. If you are a first-time user of Sezzle, you may not be approved for the full $ 2,500. Over time, by using Sezzle successfully, your limit will increase. Finally, each order is viewed individually.

Is there a downside to Sezzle?

Sezzle is not a good idea if you: This fee can be assessed once per order. Please note that if Sezzle is able to take the payment, but your debit card balance or bank account is overdrawn because of it, the card provider or bank may charge its own fee.

What happens if you stop paying Sezzle?

With around 16,000 sellers, Sezzle allows its users to make interest-free payments and even reschedule a payment once per order. If a user is unable to make a payment, Sezzle promises that there will be no collection process and it will not adversely affect your credit.

What happens if I never pay my Sezzle order?

If you miss a payment with Sezzle and are more than two days late, your account will be temporarily disabled. You will not be able to make more purchases until you reactivate your account and pay a $ 10 fee. Any outstanding amounts are transferred to the next payment date.

Will Sezzle hurt your credit?

Does Sezzle check credit? When you apply for credit using Sezzle, the service runs a soft credit check, which does not affect your credit score. This request provides the service with enough information to determine your credit rating without conducting a full credit check.

What is the highest Sezzle limit?

If you add another debit or credit card, we can help us better understand your repayment ability, which can help us get orders approved! Sezzle has a limit of $ 2500. If you are a first-time user of Sezzle, you may not be approved for the full $ 2,500. Over time, by using Sezzle successfully, your limit will increase.

Why did my Sezzle limit go down?

It is possible that your order may be rejected, even if the order amount is less than your estimated cost limit, as Sezzle considers a number of factors during the approval process. In addition to your individual consumption limit, there may also be specific restrictions on seller orders.

Does Sezzle boost your credit?

One of the main features of Sezzle Up is that it works with you to increase your credit score. When you upgrade to Sezzle Up, you choose to report the payment history to the credit bureaus. By making all payments on time, you can increase your credit score.

Can you buy gift cards with Sezzle?

By purchasing a gift card first, you will be able to shop in-store or online with sellers who are not available to standard Sezzle users. You must use the Sezzle app to buy a gift card, but then you can check out with the seller as they accept gift cards.

Can you buy on target with Sezzle? Sezzle is a payment solution that gives you the freedom to buy now and pay over time by using the Sezzle Virtual Card on Target.com and in the Target app. With Sezzle, guests are charged 25% of the purchase at check-out and the three remaining payments are automatically charged every two weeks, completely interest free.

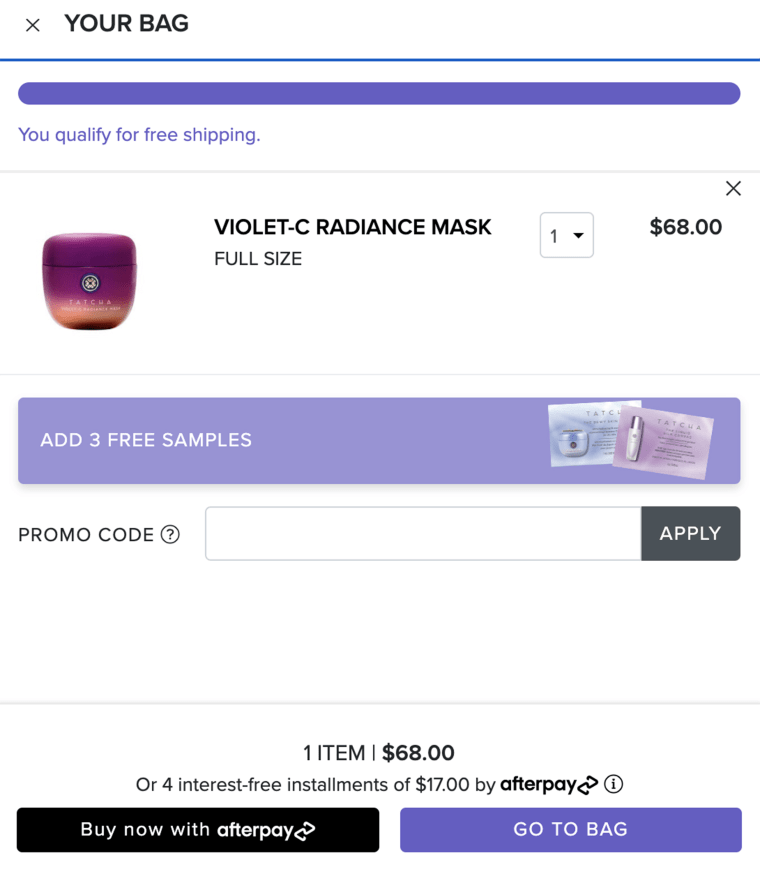

Can I buy gift cards with Afterpay?

Will I be able to buy gift cards? Afterpay gift cards are only available to Pulse Loyalty members who reach platinum, diamond or coin status.

Can I use klarna to buy gift cards?

That said, if you are considering using Klarna to buy a gift card for someone you love, you may be disappointed as Klarna does not offer gift card services.

Does Woolies accept Afterpay card?

But while Woolworths does not offer Afterpay, customers can choose PayPal at checkout and choose the service’s Pay in 4 option. PayPal’s Pay in 4 payment method works in the same way as other pay later services by dividing the total cost of purchases into four separate payments to be paid every other week.

How do you make a Sezzle gift card?

If they already have a Sezzle account (or have now signed up for one), all they have to do is log in to their account through the Sezzle app and select the « Sezzle Card » tab. We take them step-by-step through the process of getting a virtual card.

Can I use my Sezzle card in-store at Target?

Download the Sezzle app. Or sign up by clicking the Sezzle logo on the health, beauty, clothing and accessories product pages at Target.com. Activate your virtual card in the Sezzle app by going to the « Sezzle Card » tab.

Can you create a card with Sezzle?

You can use your Sezzle virtual card at select Sezzle retailers just as you would use your regular credit or debit card – over the phone, online and even in person as long as you have the card details. When you create a Sezzle account, you will have the ability to generate a Sezzle Virtual Card.

How many target orders can you have on Sezzle?

Yes, there are restrictions at Target, you can only have 3 open orders per customer service representative. You can pay one of the orders in full, to use it again at Target. I have tried to use sezzle with gift cards, but have always refused.

Does Target accept Sezzle in store?

Start shopping Activate Sezzle Virtual Card and you are ready to shop Target.com, in-store and in the Target app. Shop for any item and use Sezzle when it’s time to pay. Have Sezzle’s virtual card function at hand for quick and easy shopping wherever you are.

Does Target accept Afterpay in store? Unfortunately, Target no longer accepts Afterpay as a valid in-store payment method in the United States. It is unclear why Target stores switched from accepting this payment method in store, but we can confirm that it is no longer an option.

Does Sezzle work in-store at Target?

Shoppers can apply to use Sezzle while shopping on Target’s website or mobile app, through Sezzle’s virtual cards at checkout.

Can I use Sezzle inside Walmart?

Buy Now, Pay Later (BNPL) platform Sezzle Canada has expanded its mobile app to allow purchases from Walmart, Indigo, HomeSense, Uber and other vendors. Shoppers can make purchases and distribute their payments over four equal, interest-free installments via the app.

Can Sezzle be used in-store?

You can use the Sezzle Virtual Card to place orders either online or in-store with a virtual wallet such as Apple Pay or Google Pay at select retailers.

Can you use Sezzle in the store?

You can use the Sezzle Virtual Card to place orders either online or in-store with a virtual wallet such as Apple Pay or Google Pay at select retailers.

Can you shop at Walmart with Sezzle?

Buy Now, Pay Later (BNPL) platform Sezzle Canada has expanded its mobile app to allow purchases from Walmart, Indigo, HomeSense, Uber and other vendors. Shoppers can make purchases and distribute their payments over four equal, interest-free installments via the app.

How do you use Sezzle at checkout?

Just select Sezzle at checkout, log in or create your account and add a payment method. Sezzle makes secure payment by sending a one-time password to your phone, so make sure your phone is nearby!

Commentaires récents