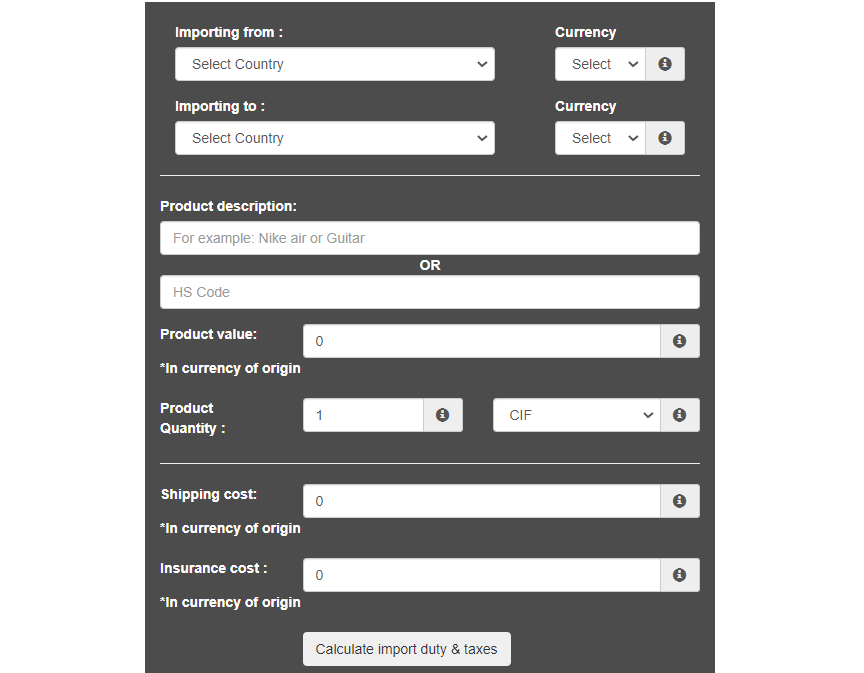

Do I pay duty on goods from China?

Normally there will be customs costs on importing goods from China, India, Taiwan and the USA, but there are some cases where customs and VAT exemption is granted. Duty and VAT exemption can be granted on a trial of a product if: Once imported, they can only be used as trial products.

Do I pay tax on imports from China? Taxes are included in the price paid to the supplier: Purchases called DDP include customs duties in addition to shipping costs and customs agent. Nevertheless, taxes such as VAT are usually not included and must be paid when they arrive at the port.

Do you have to pay duties from China?

All imports to the United States are subject to the goods handling fee. The MFP is based on the order value and is divided into two categories: Imports of goods with a value of less than 2500 USD: 2 USD, 6 USD or 9 USD per. shipping. Imports of goods worth more than US $ 2500: 0.3464% of the value of the goods.

Do you pay customs from China to UK?

The majority of goods imported from China into the United Kingdom will be subject to the full rate of duty. The customs duty is sometimes referred to as import duty, customs tariff, import duty and import duty, and is a duty levied on some exports by the Chinese customs authorities.

How much will customs charge me from China to UK?

The duty rate is 4.00%. The import VAT rate is 20%. No taxable excise duty and applicable customs preference.

Do I have to pay import tax from China to UK?

If you import from China to the UK, you must pay VAT along with the total amount of import duties and customs value. In this case, the customs value is equal to the total cost of the imported products including any import duties, supplier costs and shipping costs from China to the United Kingdom.

How much is duty on imports from China?

Customs: customs value * customs duty / imported quantity * customs duty. MPF fee: commercial value * 0.3464% (not less than 27.2 USD and more than 528.33 USD) HMF fee: commercial value * 0.125%

Does Alibaba guarantee?

Trade Assurance is Alibaba.com’s order protection service, which ensures that your product is produced to the quality you expect, paid for securely and shipped on time.

Does Alibaba charge a fee?

Alibaba.com charges a 2.95% fee when making credit card transactions, and other fees are possible when using other payment methods such as TT or ACH. When you use Alibaba.com payment terms, no fee is charged.

Does Alibaba charge foreign transaction fees? You must pay a transaction fee: 2.99% of the payment amount (up to $ 40 for MasterCard paid in US dollars in Asia Pacific and up to 3.5% for American Express payments). You can accept Visa, MasterCard, Diners, Discover, JCB, American Express.

Is Alibaba free for buyers?

If you are ready to sign up as a buyer, seller or both, you can create a free Alibaba.com account today.

How can Alibaba be used as a buyer?

Does Alibaba ship for free?

Shipping costs on Alibaba and AliExpress depend on who you buy from – manufacturers and retailers set their own prices. Many providers offer « free shipping », but they simply roll the cost over in the unit price just like dropshippers. Like Alibaba, many orders come from China.

Do you have to pay for Alibaba?

Simply pay at Alibaba, just as you would with any regular debit or credit card. The site may still charge a fee, but you avoid foreign transaction fees from your bank. You pay only a small fee to convert the currency (to the exchange rate), or no fee at all if you already have the currency in your account.

How much does Alibaba charge per transaction?

1) Payment processing fee: 2.99% of the payment amount. The fee will be automatically deducted from your account when you make the payment.

How do I pay in Alibaba safely?

Escrow. When using an escrow service, the buyer’s money is in the possession of a third party and is only paid out to the supplier after the buyer has confirmed satisfactory delivery of their order. Escrow is a fairly secure payment method for buying and selling online because it protects both buyer and supplier.

Comment buy on Alibaba as particular? Buy on Alibaba as particular Passport, location, first name, last name and phone number. Alibaba demands « Nom de l’entreprise ». Do not panic. The name may be what you want, they will not ask you more.

Comment savoir si on doit payer des frais de douane ?

To find out in detail the customs fees applicable to your delivery or receipt of packages, it is enough to go directly to the official customs site. Customs duties generally include customs duty, VAT and dossier fees.

Comment savoir si on a des frais de douane la poste ?

If you have ordered in a country outside the European Union, La Poste will demand payment of customs duties and taxes on delivery. You always receive an e-mail from La Poste Colissimo laposte.info@laposte.fr> an SMS from La Poste or Colissimo.

Comment obtenir un numéro EORI UK ?

To request an EORI UK number, consult the UK Government website (https://www.gov.uk/eori). You will receive it within a time of five working days at the latest.

Comment faire pour ne pas payer les frais de douane ?

Kommentar savoir if I have to pay or do not pay customs fees?

- If your colossus is an envoy between individuals of a value of less than 45€, it is not subject to a deduction, even to the international.

- The buyer does not pay customs duties and the VAT has already been paid by the seller.

Comment savoir si on doit payer des frais de douane ?

If the value of the shipment is higher than 150 euros, you must acquire the customs duties and VAT at the time of importation, even if it is second-hand equipment or the operation does not give place of payment. You will also pay the carrier fees.

Puis-je refuser de payer les frais de douane ?

As a recipient, you can refuse to pay customs duties and taxes will be deducted. You can send the bags to the shipper. When you do not pay customs duties for international shipping, the shipper must pay the shipping fees.

Comment éviter les frais de douane Alibaba ?

To avoid paying additional fees on AliExpress, one of the solutions for the customer is to select products in provenance of the European Union. Note that sellers outside UE adjust their prices to the bottom, of which consumers do not notice as much as the price increase.

Do I need a license to import from China to UK?

You may need an import license to import goods from China into the UK. There are import controls on a variety of goods, including firearms, food and textiles. Import licenses and certificates.

Commentaires récents