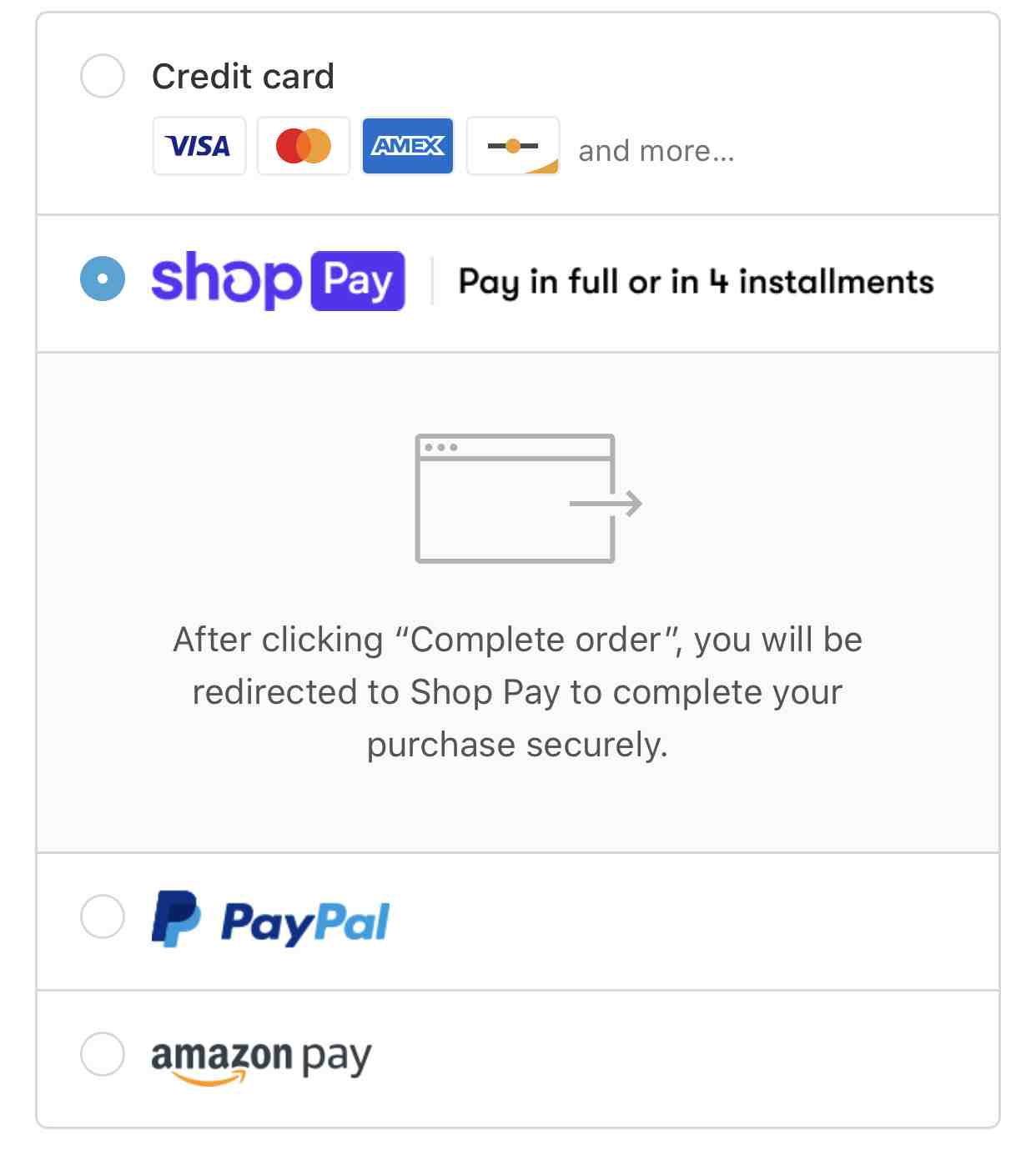

Shop Pay is an accelerated checkout that allows customers to store their email address, credit card, shipping and billing information. This can save your customers time during checkout, especially if they’ve already signed up for Shop Pay on a Shopify store.

What is the difference between shop Pay and PayPal?

| technology | Web pages |

|---|---|

| pay store | 31% 31% |

| PayPal | 69% 69% |

Is Shop Pay the same as After Pay? Shop Pay is an official checkout service provided and managed by Shopify. Is Shop Pay the same as Afterpay? Afterpay is a third-party buy-now-pay-later service that allows you to pay for purchases in 4 installments. Some Shopify stores may offer Afterpay as a payment option.

How do you Pay by shop Pay?

In Shop Pay on your desktop:

- Sign in to your Shop Pay account.

- On the home page, select the purchase you want to pay for.

- Click Make Payment.

- In the Amount to pay section, select your preferred option. …

- In the card section, use the drop-down arrow to select your preferred payment method.

- Click Pay Now.

How do you buy with shop Pay?

During checkout, the customer is redirected to Shop Pay to verify their information before returning to checkout to complete the purchase. If your store offers a local pickup or delivery option, customers can select the option during the Shop Pay checkout process.

How do shop Pay payments work?

Shop Pay gives you the option of paying in full at checkout or splitting your purchase into regular installments with Shop Pay. Installment options vary by store and can be used on orders over $50, including discounts, shipping, and taxes.

What happens when you use shop Pay?

How Shop Pay works: When customers check out, they are redirected to the order summary page. After authorizing the purchase, they will receive a six-digit code via SMS, which they enter on the checkout page. After entering the code, the order will be processed.

Can you Pay with shop Pay?

Shop Pay gives you the option of paying in full at checkout or splitting your purchase into regular installments with Shop Pay. Installment options vary by store and can be used on orders over $50, including discounts, shipping, and taxes.

Why do I have to use shop Pay?

Shop Pay speeds up this process by helping small business websites retrieve customer information. Customers can use their saved information to quickly check out instead of having to re-enter or re-verify.

How do shop Pay payments work?

The customer selects Shop Pay installments. You can choose to make four equal installments instead of paying in full. The customer selects a debit or credit card to pay for the initial payment and future installments. The account takes customers through a brief identity verification process to pay later.

How do you pay with Shop Pay? In Shop Pay on your desktop:

- Sign in to your Shop Pay account.

- On the home page, select the purchase you want to pay for.

- Click Make Payment.

- In the Amount to pay section, select your preferred option. …

- In the card section, use the drop-down arrow to select your preferred payment method.

- Click Pay Now.

Do I get my order right away with shop pay?

Your order will be shipped immediately! Don’t worry, you will receive an email reminder before each payment to remind you!

What happens when you use shop Pay?

How Shop Pay works: When customers check out, they are redirected to the order summary page. After authorizing the purchase, they will receive a six-digit code via SMS, which they enter on the checkout page. After entering the code, the order will be processed.

Do you get the product right away with shop Pay?

When will my items be delivered if I used Shop Pay to purchase the items? For all orders using Shop Pay as a payment method, the order will be processed and delivered according to our standard shipping policy.

How often do you pay with shop pay?

When you pay in installments with Shop Pay, you can split your purchase amount into 4 equal bi-weekly installments – with 0% interest, no hidden or late fees and no impact on your credit score.

What happens when you use shop Pay?

How Shop Pay works: When customers check out, they are redirected to the order summary page. After authorizing the purchase, they will receive a six-digit code via SMS, which they enter on the checkout page. After entering the code, the order will be processed.

Does shop Pay hurt your credit score?

No, verifying your eligibility with Shop Pay installments will not affect your credit score*.

What happens when you use shop pay?

How Shop Pay works: When customers check out, they are redirected to the order summary page. After authorizing the purchase, they will receive a six-digit code via SMS, which they enter on the checkout page. After entering the code, the order will be processed.

Can you Pay with shop Pay?

Shop Pay gives you the option of paying in full at checkout or splitting your purchase into regular installments with Shop Pay. Installment options vary by store and can be used on orders over $50, including discounts, shipping, and taxes.

Why do I have to use shop Pay?

Shop Pay speeds up this process by helping small business websites retrieve customer information. Customers can use their saved information to quickly check out instead of having to re-enter or re-verify.

Is AfterPay monthly or weekly?

AfterPay is a digital payment platform offered to online shoppers, allowing them to delay payments for purchases. Users can make weekly payments for items purchased until they are paid in full. No credit check is required to use AfterPay and no interest is charged.

How do I get rid of shop pay?

To opt out of Shop Pay, enter your mobile phone number in the opt-out form, then tap Submit Request. If you are paying for an order using Shop Pay installments, you can opt out after your payments are complete.

How do I cancel my Shopify Pay code? To unsubscribe, simply enter your phone number in the field below and follow the instructions. If you opt out, you will no longer be sent Shop Pay confirmation codes. Erase your phone number and all data associated with it.

Why do I keep getting shop Pay codes?

If you received a Shop Pay verification code, it could be for one of the following reasons: You’re using the same device that you used to log in the first time after setting up your account. You are using a new device or browser.

Why do I get texts from Shopify?

Every Shopify store I shop at sends me a text message that says « XXXXXX is your store payment code ». This even happens at stores I’ve never shopped at. It’s like a global Shopify payments store.

What is shop Pay code mean?

A Shop Pay code is the 6-digit code texted to a user’s phone to verify their identity for a purchase. This code is essentially the piece that allows the app to perform transactions for users that only take a few seconds.

Which one is better Afterpay or Klarna?

Our pick for the best buy now, pay later app between Klarna and Afterpay is Klarna. It offers more financing options, includes more than twice as many retailers in its marketplace, and can create virtual card numbers that can be used anywhere Visa is accepted.

What is the disadvantage of Klarna? Disadvantages explained In order to open an account with Klarna, your credit report is requested. This doesn’t affect your credit score, but it may mean that some prospects could be turned down because of bad credit or a poor credit history. Can report missed payments to credit bureaus.

Which is better Afterpay Klarna or affirm?

Afterpay is Affirm because it offers more financing options, longer terms on larger purchases, and the ability to build credit with your on-time payments. Afterpay is a good choice for four deposit loans for consumers who have bad credit or are just starting out on their credit profile.

Is Affirm better than Klarna?

Ultimately, we chose Affirm because it doesn’t charge you even if you pay late. Additionally, customers can choose from multiple payment options at checkout and fund purchases up to $17,500.

Which is best Affirm Afterpay or Klarna?

Afterpay – Typically best for smaller purchases and one of the « favorite » apps of stores targeting millennials. Affirm – usually best for larger purchases as payments can be spread out over up to three years.

Does Klarna or Afterpay affect credit score?

Klarna also doesn’t report any information to the credit bureaus about its POS loans, according to Klarna. Klarna performs a gentle credit check that doesn’t affect your credit score when you take out a Pay in 4 loan or a Pay in 30 Days loan.

Does Afterpay affect your credit score?

Using Afterpay is unlikely to affect your credit score. Afterpay doesn’t do any hard credit inquiries that can lower your score, and it doesn’t report missed payments to credit bureaus for most borrowers.

Is using Klarna bad for your credit score?

Using Klarna will not affect your credit score. However, information such as payment holidays and existing, late and unpaid balances are visible in your credit file to other lenders. Regular repayments help build a positive history of using our payment options.

Commentaires récents